A Decade in Review: What Happened to Toronto Condo Prices From 2015–2025 (And the One Year Most People Missed)

If you’ve followed the Toronto condo market for more than five minutes, you’ve probably heard at least one of these confidently delivered statements:

Condos are overpriced. Condos are crashing. Condos are dead. Condos are about to explode again.

Sometimes all in the same conversation. The problem isn’t that people are wrong. It’s that they’re usually talking about one moment in time and pretending it explains an entire decade.

Toronto condo prices don’t move in straight lines. They move in phases. And if you strip out the headlines and actually look at the data year by year, the story becomes far clearer, and far less dramatic, than most takes would have you believe.

So instead of vibes or cherry-picked charts, let’s walk through what actually happened to Toronto condo prices from 2015 to today, using real annual averages, real year-over-year changes, and the benefit of hindsight.

The Last Decade of Toronto Condo Prices

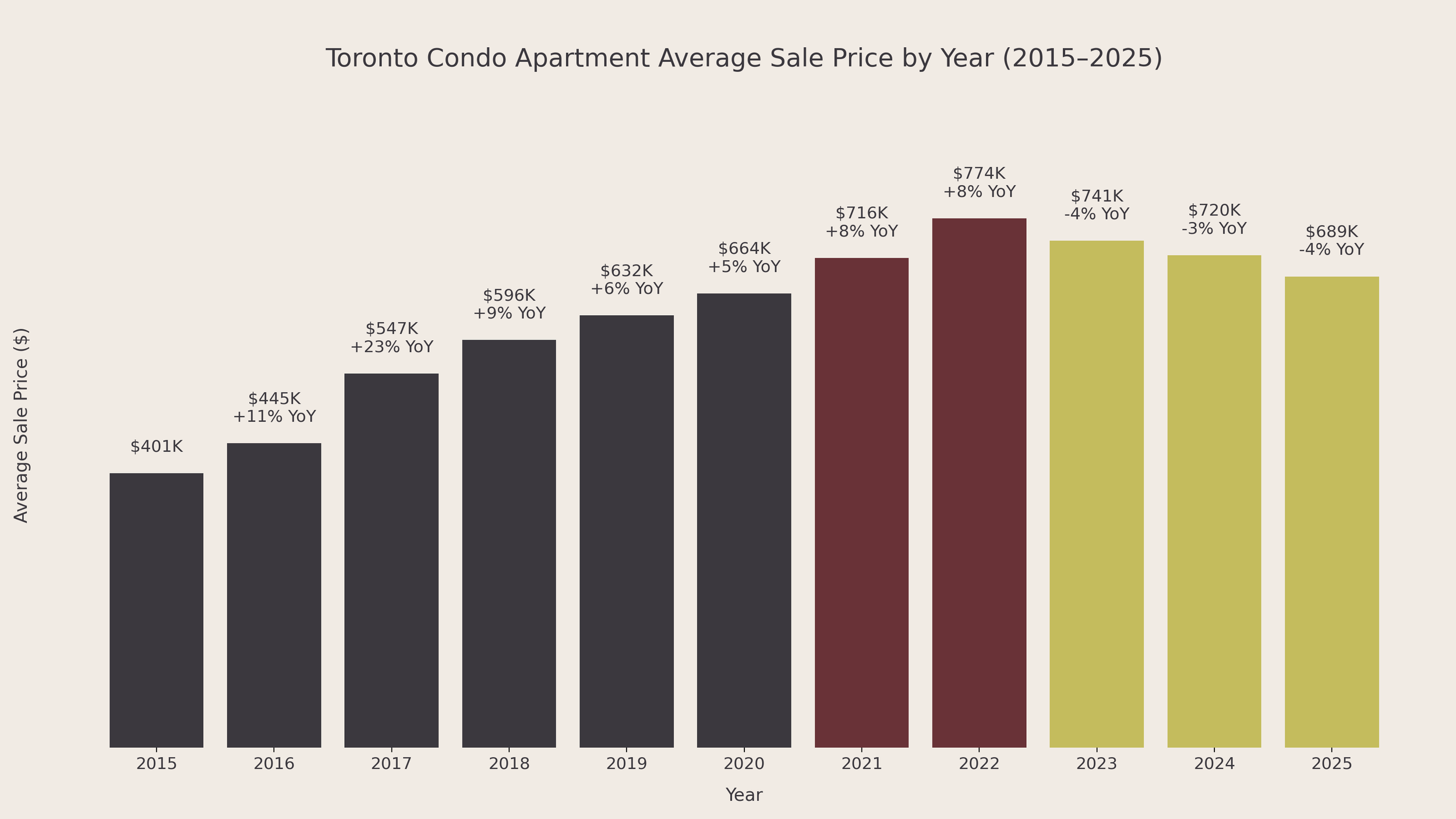

Between 2015 and early 2022, the average price of a Toronto condo apartment rose from roughly $401,000 to a peak near $774,000, an increase of about 93 percent in seven years. That growth was not evenly distributed. It accelerated sharply in a handful of key years and was later distorted by historically low interest rates.

Most people focus on the peak. Fewer notice the year when behaviour actually changed. That year was 2017, when prices surged, buyer psychology shifted, and policy makers were forced to intervene. The long-term consequences of that moment shaped everything that followed, including the low-rate excesses of 2020 and 2021 and the slow correction that came after.

From 2022 through 2025, prices corrected approximately 10 to 12 percent, not through a sudden collapse, but through a slow, grinding adjustment as borrowing costs rose and buyer behaviour recalibrated.

This was not a boom-and-bust story. It was a cycle of acceleration, distortion, correction, and normalization. Here’s how that played out, year by year.

2017 stands out not because prices peaked, but because the rate of growth did. No year since has matched that pace. All pricing data reflects Toronto condo apartment averages based on TRREB market statistics.

Toronto Condo Prices by Year: What Happened,

and Why It Happened

Please keep in mind that these are city-wide averages. Individual buildings, layouts, and neighbourhoods often moved very differently within the same year.

2015: A Market Still Driven by Fundamentals

Average price: $401,000

In 2015, the Toronto condo market still functioned like a pricing mechanism rather than a momentum machine. Interest rates were low, but not treated as permanent. Buyers evaluated deals based on livability and long-term affordability, not just access to leverage. Investors expected modest appreciation and cared deeply about rent coverage. When deals didn’t work, they simply didn’t happen.

Policy pressure was minimal, foreign buyer participation existed but wasn’t dominant, and pre-construction activity was steady rather than frenzied. Vacancy was not a political issue yet, and housing was still discussed primarily as shelter rather than a macroeconomic concern. This year matters because it establishes the last point at which risk, price, and behaviour were broadly aligned. Everything that followed represents a gradual departure from this baseline.

2016: Demand Increases, Growth Feels Earned

Average price: $445,000

Year-over-year change: +11%

By 2016, the Toronto condo market was absorbing pressure that policy had not yet caught up to. The Bank of Canada’s overnight rate sat at 0.50 percent, mortgage rates were historically low, and borrowing capacity expanded faster than supply. Detached and semi-detached prices accelerated sharply, pushing buyers into condos not as a lifestyle preference, but as a necessity.

What mattered most this year wasn’t price growth itself, which came in around 11 percent, but where demand was coming from. Domestic end users were competing with investors, and pre-construction condos began selling rapidly as buyers tried to lock in future affordability. Risk was still being priced, but margins were thinning. Policy had not yet intervened, and the market was quietly loading tension.

This was the year demand structurally shifted downward into condos, setting the stage for what followed.

2017: Rapid Price Acceleration Forces a Policy Response

Average price: $547,000

Year-over-year change: +23%

In 2017, the Toronto condo market experienced its sharpest annual price increase of the decade, rising more than 23 percent year over year. This growth coincided with a surge in investor participation, aggressive pre-construction sales, and intensified competition from both domestic and foreign capital.

Crucially, this was also the year governments intervened after behaviour had already changed. Ontario’s Fair Housing Plan introduced rent controls on new units and expanded the Non-Resident Speculation Tax. Federally, OSFI announced the B-20 mortgage stress test, which would come into force in early 2018.

But the damage was already done. Buyers had stopped stress-testing affordability themselves. Investors underwrote deals assuming continued appreciation. Pre-construction units sold out rapidly, often before pricing fully reflected end-market risk. Policy slowed momentum, but it did not reset expectations. This year permanently redefined what buyers believed condos were worth.

2018: Cooling Without a Breakdown

Average price: $596,000

Year-over-year change: +9%

By 2018, the market was absorbing the delayed impact of multiple policy interventions. The OSFI B-20 mortgage stress test came into effect federally, materially reducing purchasing power for leveraged buyers. Ontario’s Fair Housing Plan and rent control expansion had already cooled speculative enthusiasm, particularly among investors chasing short-term gains.

What changed this year wasn’t demand, but friction. Financing approvals took longer. Qualification amounts shrank. Buyers became more selective because they had to be. Pre-construction absorption slowed as assignment risk became harder to ignore. Importantly, prices still rose, but growth decelerated meaningfully.

This year matters because it disproves a persistent myth. Policy intervention doesn’t necessarily cause crashes. More often, it removes excess. 2018 showed that the Toronto condo market could slow, discipline itself, and continue functioning without unraveling.

2019: Stability Returns at a Higher Price Point

Average price: $632,000

Year-over-year change: +6%

In 2019, the Toronto condo market settled into a new operating mode. Buyers had internalized the stress test. Investors adjusted expectations. Pre-construction buyers became more cautious, focusing on reputable developers, realistic completion timelines, and exit strategies that didn’t rely on rapid appreciation.

Foreign capital was still present, but no longer dominant. Domestic end users and long-term investors drove demand. Price growth slowed further, not because confidence was low, but because affordability ceilings were becoming real. This year is important because it demonstrates how markets normalize after intervention. Not by reversing prices, but by changing behaviour.

2019 was not exciting, but it was healthy. It showed what a constrained, disciplined market looks like when speculation retreats and fundamentals regain influence.

2020: When the Market Was Shocked, Then Re-Sorted

Average price: $664,000

Year-over-year change: +5%

The pandemic represented the first real systemic shock to Toronto condos in over a decade. Short-term rental demand collapsed, immigration paused, and downtown vacancy rose. At the same time, the Bank of Canada slashed rates to near zero, dramatically reducing borrowing costs.

What followed was not a collapse, but a re-sorting of participants. Highly leveraged short-term investors exited quietly. End users and long-term investors stepped in, attracted by low rates and discounted carrying costs. Average prices still rose roughly 5 percent by year-end, despite the narrative of urban decline.

This year proved that policy support, particularly ultra-low rates, could override negative sentiment, and that underlying housing demand remained intact even when daily life was disrupted.

2021: When Cheap Money Masked Every Risk Signal

Average price: $716,000

Year-over-year change: +8%

In 2021, the market stopped pricing risk properly. The Bank of Canada maintained emergency-level rates, mortgage costs fell further, and borrowing capacity expanded dramatically. Buyers weren’t stress-testing interest rates because they didn’t have to. Investors underwrote deals based on monthly payments that assumed low rates indefinitely. Variable-rate buyers felt insulated. Pre-construction condos sold aggressively as investors chased leverage, not yield.

At the same time, construction costs surged and completion timelines stretched, increasing long-term risk that few participants acknowledged. Assignments penciled because financing was easy, not because fundamentals improved. Almost nothing broke in real time, which is exactly why so many people misread this year as healthy. Risk didn’t disappear. It was deferred.

2022: Peak Prices Meet a Rate Shock

Average price: $774,000

Year-over-year change: +8%

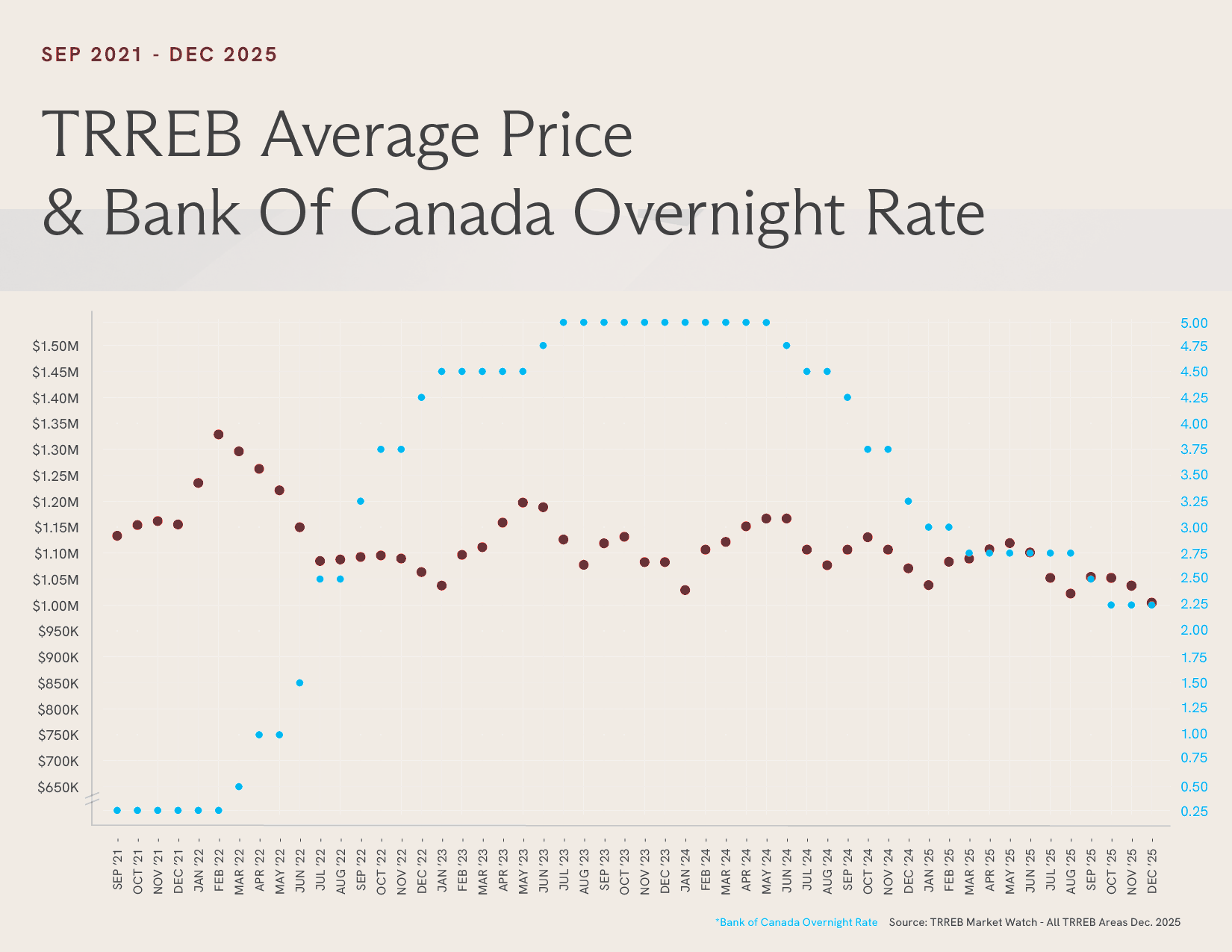

By early 2022, prices reached their peak, but the underlying shift had already begun. The Bank of Canada initiated one of the fastest rate-hiking cycles in its history, moving from near-zero to over 4 percent in less than a year. Mortgage qualification amounts dropped sharply. Rate holds expired. Deals that worked months earlier no longer did.

Foreign buyers, already reduced by the Non-Resident Speculation Tax, were further sidelined by the federal foreign buyer ban introduced in 2023, removing another layer of demand from pre-construction and resale markets.

This year matters because it shows how markets actually turn. Confidence broke before prices reflected it. Volume slowed first. Behaviour changed next. Prices followed later. Those waiting for a visible “crash” missed the signal entirely.

2023: When the Math Finally Stopped Mathing

Average price: $741,000

Year-over-year change: −4%

In 2023, higher interest rates forced discipline back into the market. The mortgage stress test became binding again. Investor cash-flow assumptions failed. Pre-construction buyers faced negative assignment spreads as resale pricing softened and financing costs rose.

Sales volumes dropped materially, even as prices adjusted more modestly, falling roughly 4 percent year over year. Vacancy taxes, higher carrying costs, and tighter lending conditions pushed speculative capital further out of the market. Buyers regained leverage not because prices collapsed, but because fewer deals made sense.

This was the year the correction became unavoidable, even if it didn’t look dramatic.

2024: Sideways Markets Test Patience

Average price: $720,000

Year-over-year change: −3%

By 2024, the correction was well underway, but the market was no longer reacting emotionally. Instead, it entered a phase of strategic paralysis. Buyers believed rates would eventually fall and waited. Sellers believed prices would eventually recover and waited. Transaction volume suffered more than pricing.

Policy pressure was fully embedded at this point. The foreign buyer ban was in effect, vacancy taxes were enforced, and financing costs remained elevated. Pre-construction activity slowed dramatically as both developers and investors reassessed viability under higher interest rates and construction costs.

This year matters because it illustrates how markets stall not due to fear, but due to misaligned expectations. Nothing was “wrong” enough to force capitulation, but nothing was attractive enough to spark momentum. That tension defined 2024.

2025: Repricing Near the Bottom of the Cycle

Average price: $689,000

Year-over-year change: −4%

By 2025, the Toronto condo market finally recalibrated around a higher-rate reality. Buyers no longer assumed relief was imminent. Sellers stopped anchoring to 2021 pricing. Deals began closing again, but only when they made sense under current financing conditions.

Investor participation returned selectively, focused on strong buildings, realistic rents, and long-term holds. Pre-construction demand remained muted, reflecting both financing risk and a broader reassessment of speculative exposure. With foreign buyers largely absent and vacancy costs real, the market rewarded prudence.

This year marks the end of denial. Prices settled roughly 10 to 12 percent below peak levels, not because of forced selling, but because expectations finally aligned with reality. The cycle didn’t end in panic. It ended in discipline.

What This Means for Toronto Condo Buyers and Sellers in 2026?

For buyers: Buying a condo in Toronto in 2026 isn’t about timing a rebound. It’s about buying into a market that has already adjusted to higher rates and reset expectations. Prices have stabilized, sellers are more realistic, and buyers are underwriting deals based on real affordability, not future rate guesses. That creates leverage of a different kind. Less urgency, more choice, and room to negotiate on quality rather than speed. For buyers, 2026 rewards patience, strong fundamentals, and long-term thinking.

For sellers: For sellers, 2026 is not a return to the chaos of the low-rate years, but it is a market that works again. Well-priced, well-presented condos are selling. Overpriced ones aren’t. Buyers are cautious, informed, and selective, which means pricing and positioning matter more than ever. Sellers who align with today’s reality are still getting deals done, often faster than expected.

So What’s the Real Takeway?

If there’s one lesson from the last decade of Toronto condo prices, it’s this: the market doesn’t move in straight lines, and it doesn’t reward shortcuts for very long.

Cheap money distorted behaviour. Higher rates forced a reset. And what we’re left with in 2026 is a condo market that has recalibrated around reality. Not fear. Not hype. Reality.

This isn’t the kind of market where you win by rushing. It’s the kind where you win by understanding how we got here and making decisions that actually hold up over time.

Are you thinking of buying or selling a condo in 2026?

Understanding Toronto condo market trends is one thing. Applying them to a specific building, unit type, or timeline is another.

If you’re thinking about buying a condo in Toronto or selling a condo in Toronto, the right move depends on where we are in the cycle, not where prices used to be.

If you want a clear, no-pressure take on how this data applies to your situation, I’m always happy to talk it through.

👉 Book a strategy call

👉 Get a custom home value or buying plan

👉 Ask a question you can’t Google

You don’t need to time the market.

You need to understand it.