A Decade in Review: What Happened to Toronto Condo Prices From 2015–2025 (And What Happens Next…)

If you have followed the Toronto condo market for even a short period of time, you have likely heard strong opinions delivered with total confidence. Condos are overpriced. Condos are crashing. Condos are dead. Condos are about to explode again. Sometimes all of those claims show up in the same conversation.

The issue is not that these statements are entirely wrong. It is that they isolate one moment in time and treat it as representative of an entire cycle. Toronto condo prices do not move in straight lines. They move in phases. When you examine pricing alongside sales volumes, inventory levels, absorption rates, credit conditions, and construction activity, the pattern becomes far clearer and far less dramatic than headline narratives suggest.

This is not just a pricing story. It is a demand story, a credit cycle story, and ultimately a supply story. Prices are often the last visible signal of what is already happening underneath the surface.

The Three Phases of the Toronto Condo Market (2015–2026)

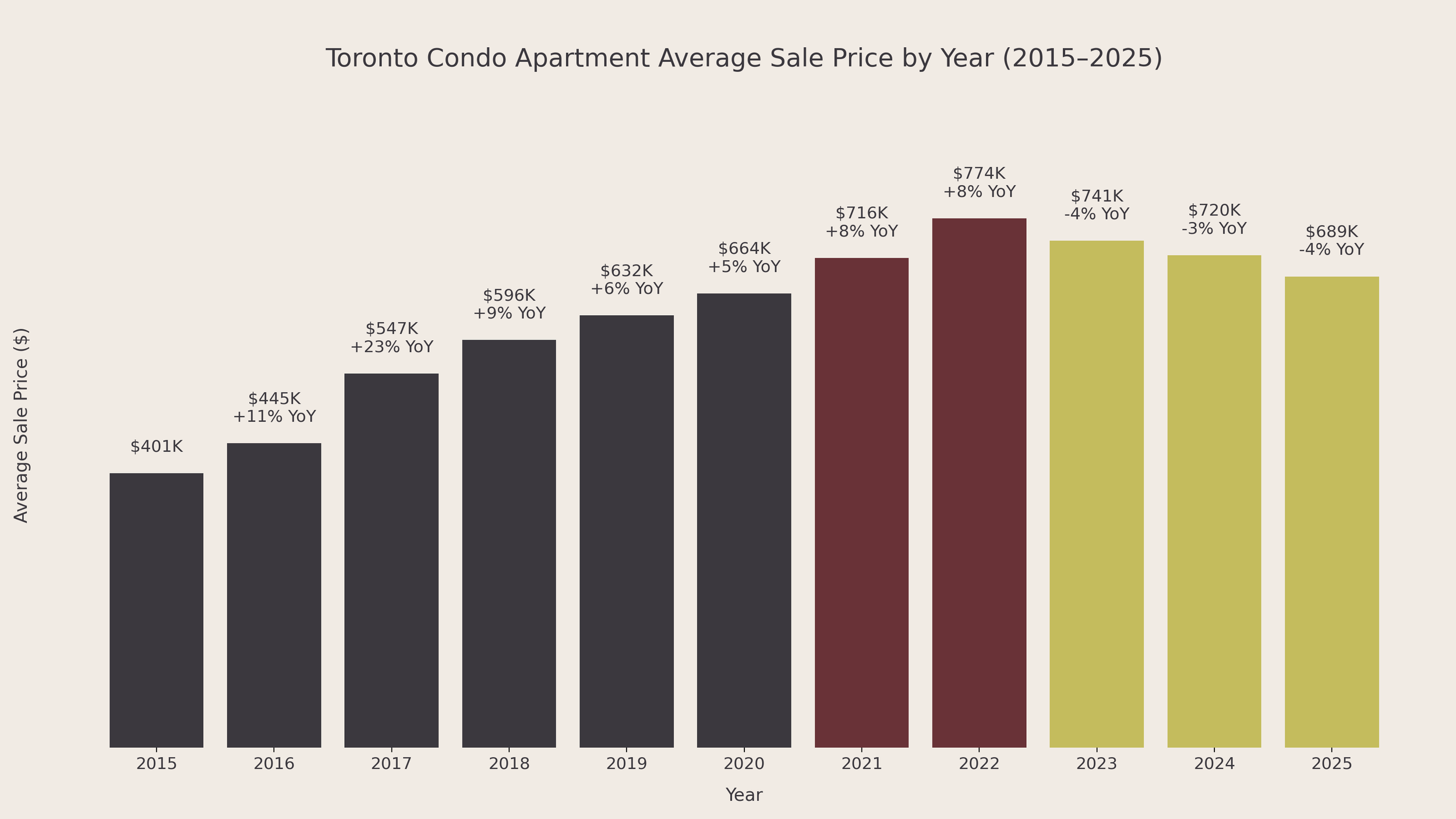

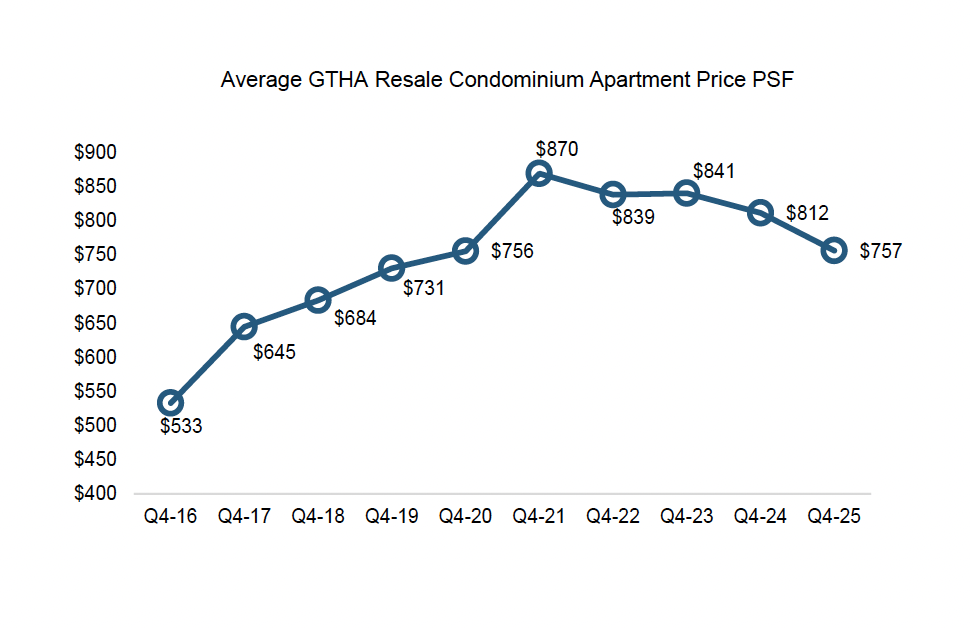

Between 2015 and early 2022, the average price of a Toronto condo apartment rose from approximately $401,000 to a peak near $774,000, representing roughly 93 percent growth in seven years. On its own, that statistic suggests a single upward trajectory. In reality, the decade unfolded in three distinct phases: expansion from 2015 to 2019, credit distortion from 2020 to 2021, and demand collapse followed by structural reset from 2022 to 2025.

Understanding these phases matters more than focusing on any individual year because each phase reshaped the market differently and set the conditions for the next.

All pricing data reflects Toronto condo apartment averages based on TRREB market statistics.

Phase One: Expansion Built on Fundamentals (2015–2019)

From 2015 through 2019, the Toronto condo market expanded steadily. Prices increased as low-rise housing became less affordable and urban density intensified. Demand was supported by population growth, strong employment, and limited supply of new ground-related homes. Policy interventions such as Ontario’s Fair Housing Plan and the federal B-20 mortgage stress test were introduced during this period, yet the market continued functioning without systemic disruption.

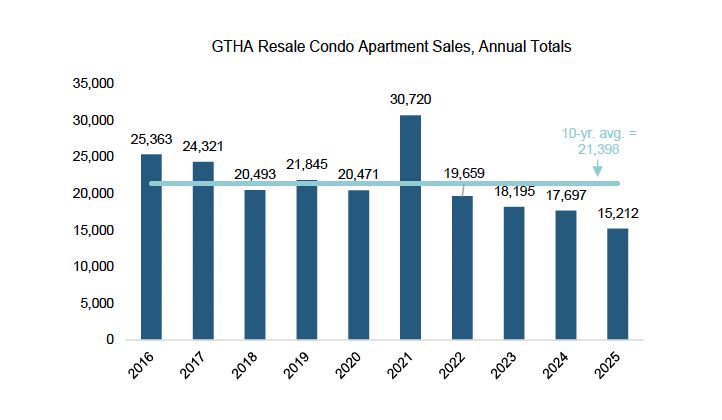

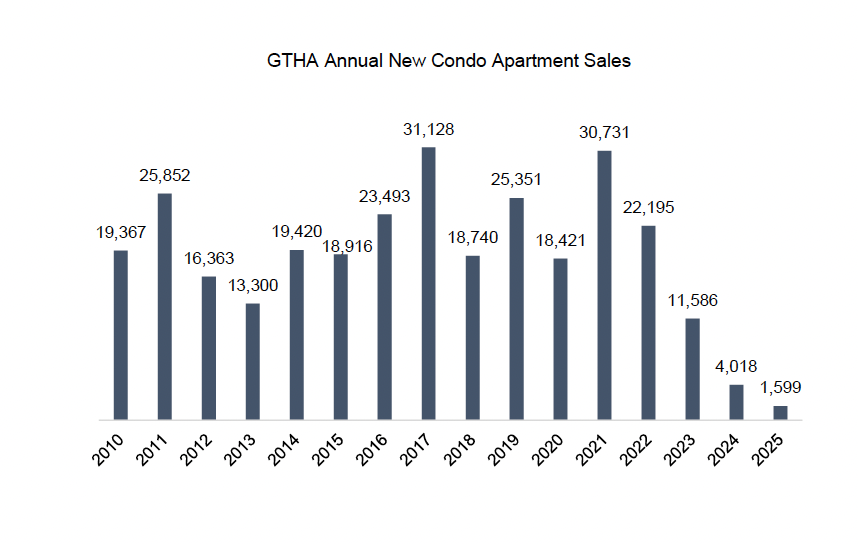

New condo sales during this expansion phase broadly aligned with long-term demand trends. The ten-year historical average for annual new condominium sales in the Greater Toronto and Hamilton Area is approximately 18,700 units. While some years saw sharper price acceleration than others, absorption remained healthy and projects continued launching. Buyers adjusted to qualification rules, and the system remained responsive to tightening credit conditions.

These figures are drawn from the Q4 2025 Urbanation Condominium Market Survey, which tracks resale condominium activity across the GTHA.

Phase Two: Credit Distortion and the Sales Surge (2020–2021)

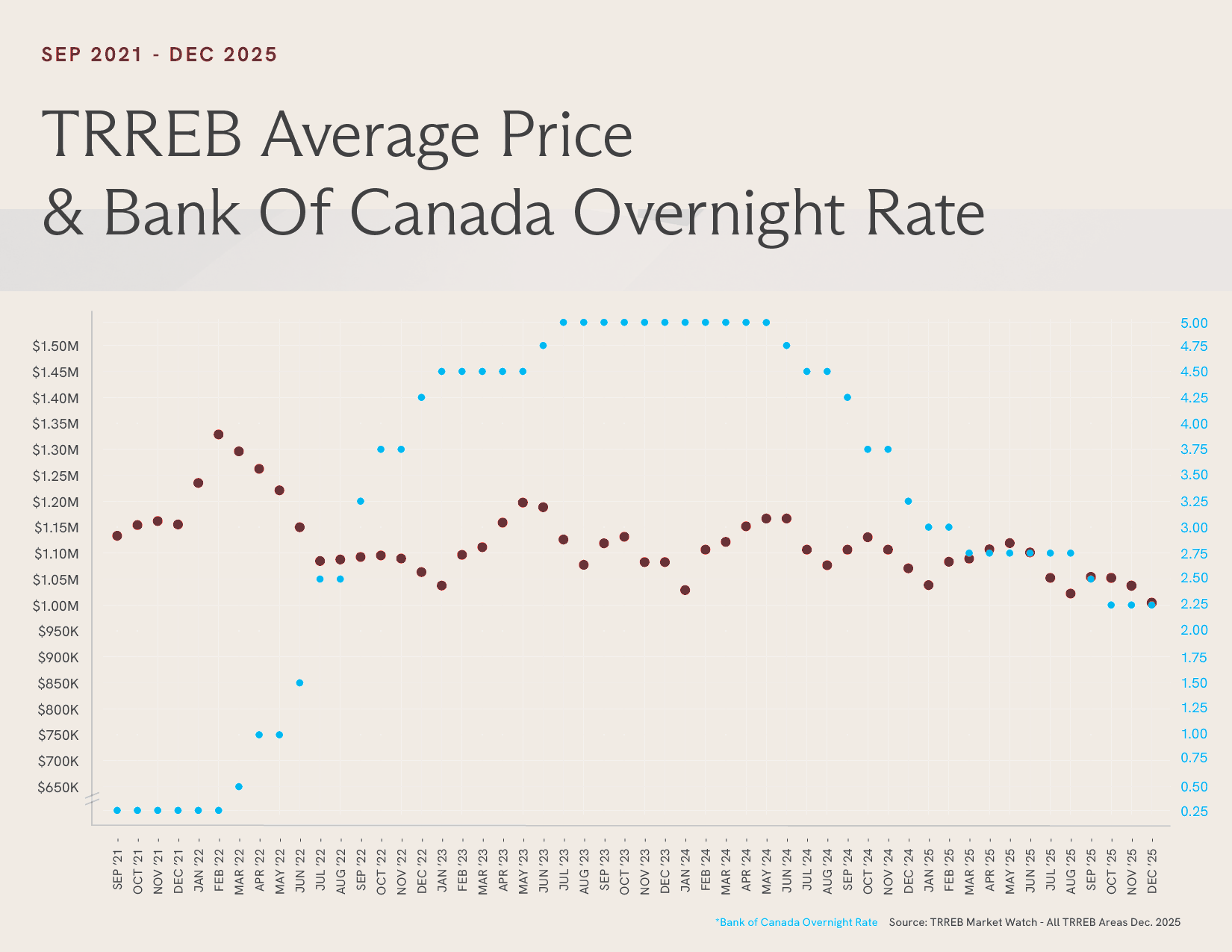

The second phase began when the pandemic triggered an aggressive monetary response. Interest rates were reduced to near zero, dramatically expanding borrowing capacity and lowering monthly carrying costs. Credit conditions became historically loose, and demand surged well beyond long-term norms.

In 2021 alone, nearly 31,000 new condominium units were sold across the GTHA, far exceeding the historical average of roughly 18,700 units per year. This was not merely strong demand. It was demand amplified by ultra-cheap leverage. Pre-construction launches were absorbed quickly, investor participation intensified, and pricing power strengthened across new projects.

At the time, almost nothing appeared broken. In hindsight, sales volumes were running significantly ahead of sustainable levels, supported by temporary monetary conditions that could not persist indefinitely.

Phase Three: Demand Collapse and Structural Reset (2022–2025)

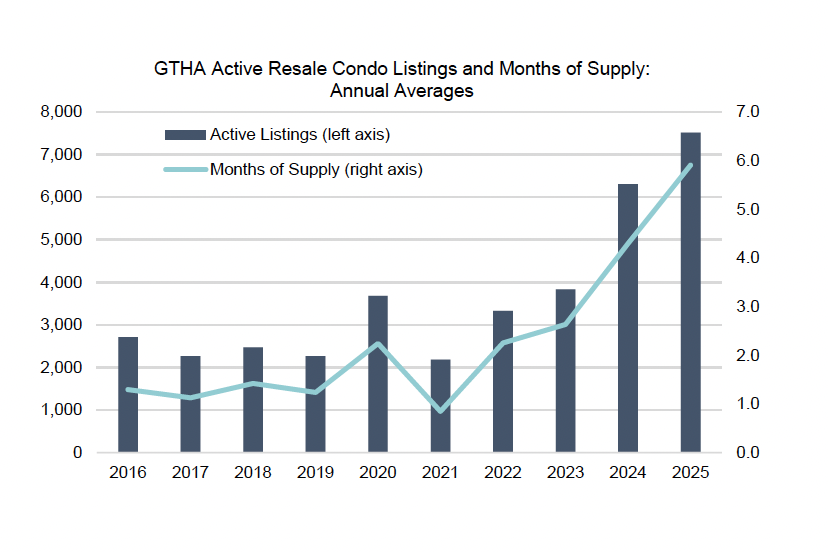

The third phase began when the credit cycle reversed in 2022. The Bank of Canada initiated one of the fastest rate-hiking cycles in modern Canadian history. Borrowing capacity contracted rapidly, and carrying costs increased materially. Financing assumptions that worked under ultra-low rates no longer held under higher-rate reality.

The clearest signal of structural change was not price. It was new condo sales. By 2025, annual new condominium sales had fallen to just 1,599 units. That represents a 60 percent decline from 2024 and approximately a 95 percent decline from the 2021 peak. It is the lowest annual total recorded since 1991. In the fourth quarter of 2025, only 262 new condo units sold, marking the weakest quarter since 1990.

As demand contracted, inventory accumulated. Unsold new condo inventory climbed above 20,500 units, pushing months of supply to 154 months. Completed and standing inventory reached record levels, and approximately 10 percent of presold units failed to close and returned to developers. Resale prices adjusted gradually, eventually sitting approximately 22.8 percent below their early 2022 peak by the end of 2025.

The system did not collapse. It recalibrated. Demand retreated, supply expanded temporarily, and future construction slowed dramatically.

2015: A Market Still Driven by Fundamentals

Average price: $401,000

In 2015, the Toronto condo market still operated within traditional economic boundaries. The Bank of Canada’s overnight rate held at 0.50 percent, supporting affordability without creating speculative urgency. GTA condo apartment sales hovered near long-term averages of roughly 20,000 transactions annually.

Buyers evaluated affordability based on income, rent coverage, and livability rather than leverage alone. Policy pressure was minimal, foreign capital was present but not dominant, and housing was discussed primarily as shelter rather than systemic risk. Risk, price, and behaviour were broadly aligned.

2016: Demand Increases, Growth Feels Earned

Average price: $445,000

Year-over-year change: +11%

By 2016, detached and semi-detached home prices were accelerating at double-digit rates, pushing buyers structurally into condos. The Bank of Canada kept its overnight rate at 0.50 percent, and mortgage credit remained highly accessible. Condo sales increased and price growth accelerated to 11 percent year over year.

What changed was not just pricing, but composition. End users and investors were now competing in the same segment. Pre-construction activity intensified as buyers attempted to secure future affordability. Policy had not yet intervened, and the market was absorbing pressure that regulators had not priced in.

2017: Rapid Price Acceleration Forces a Policy Response

Average price: $547,000

Year-over-year change: +23%

In 2017, the condo market experienced its fastest annual growth of the decade, rising 23 percent year over year. Investor participation increased sharply, and pre-construction units sold quickly, often before full end-market risk was reflected in pricing. Mid-year, Ontario introduced the Fair Housing Plan, expanding the Non-Resident Speculation Tax and implementing rent controls on new units. Federally, regulators announced the B-20 mortgage stress test, which would require borrowers to qualify at higher interest rates starting in 2018.

The key insight is timing. Policy followed behaviour. The acceleration had already occurred. The year marked a shift in psychology, as buyers recalibrated what condos were worth under continued low rates and rising competition.

According to Urbanation’s quarterly tracking of new condominium sales, 2025 marked one of the weakest annual totals in decades.

2018: Cooling Without a Breakdown

Average price: $596,000

Year-over-year change: +9%

In January 2018, the federal B-20 mortgage stress test came into effect, requiring borrowers to qualify at higher benchmark rates. Purchasing power declined immediately, particularly for leveraged buyers. At the same time, Ontario’s Fair Housing Plan and expanded rent controls were already cooling speculative enthusiasm.

Growth slowed from 23 percent in 2017 to 9 percent year over year. Sales volumes moderated as qualification amounts shrank and financing approvals became more difficult. Pre-construction absorption softened as assignment risk became harder to ignore. What changed was not underlying demand, but friction. Buyers became more selective because they had to be.

Importantly, prices did not reverse. The market absorbed tighter credit conditions without systemic stress. 2018 demonstrates a recurring pattern in real estate cycles: credit policy alters behaviour before it alters price. Intervention removed excess, but the broader expansion phase remained intact.

2019: Stability Returns at a Higher Price Point

Average price: $632,000

Year-over-year change: +6%

In 2019, the Toronto condo market settled into a new operating mode. Buyers had internalized the stress test. Investors adjusted expectations. Pre-construction buyers became more cautious, focusing on reputable developers, realistic completion timelines, and exit strategies that didn’t rely on rapid appreciation.

Foreign capital was still present, but no longer dominant. Domestic end users and long-term investors drove demand. Price growth slowed further, not because confidence was low, but because affordability ceilings were becoming real. This year is important because it demonstrates how markets normalize after intervention. Not by reversing prices, but by changing behaviour.

2019 was not exciting, but it was healthy. It showed what a constrained, disciplined market looks like when speculation retreats and fundamentals regain influence.

2020: When the Market Was Shocked, Then Re-Sorted

Average price: $664,000

Year-over-year change: +5%

The pandemic delivered the first true systemic shock to Toronto condos in over a decade. Immigration paused, short-term rental demand collapsed, and downtown vacancy rose. Sales slowed sharply during lockdowns.

Even so, GTA new condominium apartment sales still totaled approximately 20,085 units in 2020, and more than 20,300 units were completed that year. Supply continued moving despite the disruption.

The Bank of Canada cut its overnight rate to 0.25% and launched quantitative easing, pushing five-year fixed mortgage rates below 2 percent. Borrowing costs fell dramatically.

The result was not collapse, but re-sorting. Short-term investors exited, longer-term buyers stepped in, and average condo prices still rose roughly 5% by year-end. The shock was real. The stimulus was stronger. Risk was deferred into the surge that followed.

2021: When Cheap Money Masked Every Risk Signal

Average price: $716,000

Year-over-year change: +8%

In 2021, the market stopped pricing risk properly. Emergency-level interest rates kept borrowing costs near historic lows, and purchasing power expanded dramatically. Investors underwrote deals based on ultra-cheap monthly payments, often assuming those conditions would last.

The real signal of excess was sales volume. Nearly 31,000 new condominium units sold across the GTHA in 2021, far above the long-term annual average of roughly 18,700 units. Pre-construction launches were absorbed quickly, leverage intensified, and demand ran ahead of sustainable levels.

Almost nothing broke in real time. That is exactly why so many mistook the year for stability. Risk did not disappear. It was deferred.

2022: Peak Prices Meet a Rate Shock

Average price: $774,000

Year-over-year change: +8%

Early 2022 marked the pricing peak, but the structural shift had already begun. The Bank of Canada launched one of the fastest rate-hiking cycles in its history, moving from near-zero to above 4 percent within months. Qualification amounts fell, rate holds expired, and deals that worked under ultra-low financing no longer penciled.

The first signal was not price. It was demand. New condo sales began falling sharply as borrowing capacity contracted. Volume slowed before pricing adjusted.

Markets do not turn all at once. Confidence breaks first, behaviour changes next, and prices follow later. 2022 was the year that sequence began.

2023: When the Math Finally Stopped Mathing

Average price: $741,000

Year-over-year change: −4%

By 2023, the correction was fully visible in both resale pricing and new condo activity. Higher interest rates forced discipline back into the market. The mortgage stress test became binding again, investor cash-flow assumptions failed, and many pre-construction buyers faced negative assignment spreads as financing costs rose.

New condo demand continued to weaken and inventory accumulated quickly. Unsold new condominium inventory climbed above 20,500 units by late 2025, reflecting a market where new supply was vastly outpacing absorption . At the same time, approximately 10 percent of presold units failed to close and returned to developers. The system did not collapse, but it stalled under the weight of higher borrowing costs and reduced buyer capacity.

Resale volumes declined materially, while prices fell a more modest 4 percent year over year. Buyers regained leverage not because prices crashed, but because fewer transactions made financial sense. By the end of 2023, the correction was no longer theoretical. It was structural.

2024: Sideways Markets Tests Patience

Average price: $720,000

Year-over-year change: −3%

By 2024, the correction was well underway, but the market was no longer reacting emotionally. It entered a phase of strategic paralysis. Buyers anticipated rate cuts and waited. Sellers anchored to prior pricing and waited. Transaction volume suffered more than pricing because neither side felt enough pressure to move decisively.

Economic context explains the stall. After peaking above 5 percent in 2023, the Bank of Canada’s overnight rate held in the mid-4 percent range for much of 2024. Five-year fixed mortgage rates generally sat between 5 and 6 percent. Financing was no longer rising aggressively, but it remained materially higher than during the 2020–2021 surge. That stabilization created hesitation rather than panic.

The imbalance showed up clearly in resale data. Months of supply reached 4.0 months in the fourth quarter, compared to a ten-year average of 1.6 months. The sales-to-listings ratio fell to 33 percent, and resale condo prices sat approximately 22.8 percent below their early 2022 peak. The adjustment unfolded gradually rather than violently.

Nothing was broken enough to force capitulation, but nothing was attractive enough to spark momentum. That tension defined 2024.

2025: Repricing Near the Bottom of the Cycle

Average price: $689,000

Year-over-year change: −4%

By 2025, expectations began aligning with financing reality. Ownership costs for a typical 700 square foot resale condo declined approximately 22 percent over two years and moved to within roughly $131 of comparable rents. Entry-level resale transactions under $500,000 surged 73 percent, doubling their share of the market.

The year initially showed signs of renewed activity as buyers adjusted to higher-rate conditions and began underwriting deals more conservatively. However, momentum softened in the second quarter as renewed trade tensions and tariff discussions out of the United States introduced fresh economic uncertainty into financial markets. Broader risk aversion temporarily slowed transaction velocity, particularly among discretionary buyers. Even so, the broader condo asset class remained active, with more than 80,000 resale and rental transactions recorded in 2025. The correction did not reverse course; it evolved. What began as contraction gradually transitioned into recalibration under a higher-rate and more cautious global environment.

The Supply Consequences of the Reset

While pricing and sales volume attract most of the attention, the more important shift is happening in future supply.

Condo construction starts have declined approximately 88% over the past three years. In 2025, only 3,272 condo units began construction, marking a multi-decade low. At the same time, 7,243 condo units were cancelled in 2025 alone, representing a record level of project cancellations.

Nearly 29,300 units were completed in 2025, reflecting projects initiated during the low-rate surge. However, completions are projected to decline sharply to roughly 22,000 in 2026 and approximately 14,366 in 2027. Under current construction trends, virtually no new condo supply is expected by 2029.

I wrote a deeper breakdown on when the Toronto condo market could rebound and what the 2028 outlook looks like here.

The correction did not simply reset pricing. It materially curtailed future construction. The inventory we are digesting today was planned years ago. The shortage risk building for the late 2020s is being created right now.

Demand Did Not Disappear. It Shifted.

While new condo sales reached a 35-year low, activity in the existing condo market reached a record high. In 2025, a total of 80,155 condo units were either resold or leased. That was 9 percent higher than 2024 and 29 percent above the 10-year average.

This increase was driven primarily by rental transactions, which rose 16 percent to a record 64,943 units. Resale transactions totaled 15,212 units. Even at their lowest annual level since 2008, resale activity was ten times higher than new condo sales.

This divergence is important because it demonstrates that demand for condo living remains strong. Buyers and renters did not leave the market. Instead, they shifted toward existing inventory, where pricing has adjusted and financing risk is more transparent. Additionally, resale transactions for units priced under $500,000 increased 73 percent in 2025.

This growth was driven by improved affordability and lower borrowing costs compared to peak-rate levels. The data suggests that the condo market is not structurally weak. It is undergoing a repricing that has brought real end users back into the entry-level segment.

What This Means for Toronto Condo Buyers and Sellers in 2026?

The market in 2026 is no longer driven by panic or by easy credit. It is being driven by math.

For buyers: that means affordability has improved meaningfully from peak conditions. Ownership costs have come down, competition is calmer, and pricing expectations are more realistic. This is not a speculative environment. It is one where due diligence, building quality, and long-term fundamentals matter again. Buyers who are financially prepared and patient have more leverage than they did during the low-rate surge.

For sellers: 2026 is not a return to the frenzy of 2021, but it is also not the paralysis of 2023. Condos that are priced correctly and positioned well are selling. Units that are anchored to peak pricing are sitting. Strategy matters more than optimism. Sellers who understand where we are in the cycle are still getting deals done.

The near-term reality is that inventory still needs to clear. The medium-term reality is that new supply is collapsing. Both can be true at the same time.

Are you thinking of buying or selling a condo in 2026?

The Toronto condo market does not move in straight lines, and it rarely turns all at once. Cheap money distorted behaviour. Higher rates forced discipline. The result is a market that has recalibrated around fundamentals rather than leverage.

In 2026, we are not at the beginning of a boom. We are at the end of a reset. The market is transitioning from absorbing excess supply to facing a future where new supply may be far more limited than most people expect.

This is not a market where you win by rushing. It is a market where you win by understanding the cycle and making decisions that hold up beyond headlines.

If you are thinking about buying a condo or selling a condo in 2026, knowing the data is one thing. Knowing how it applies to your building, your price range, and your timeline is another.

If you want a clear, practical take on how this cycle affects you, I am always happy to talk it through.

👉 Book a strategy call

👉 Get a custom home value or buying plan

👉 Ask a question you can’t Google

You don’t need to time the market.

You need to understand it.